Global innovation in traditional meat alternatives – namely plant-based and cultivated meat – has faced a downward correction after years of consistent growth, according to the latest patent data* reported by Appleyard Lees.

These are among the findings in the fifth annual edition of the now-published Inside Green Innovation: Progress Report** from the leading intellectual property firm.

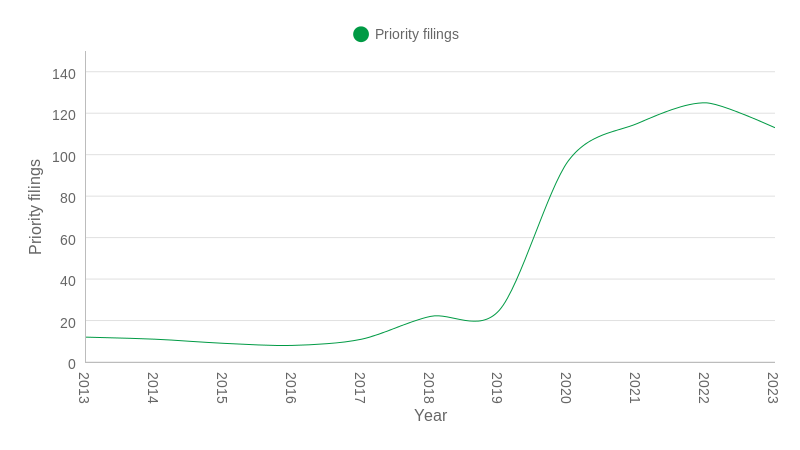

Annual patent filings for cultivated meat inventions fell by almost 10% (from 125 in 2022 to 113 in 2023) compared to a circa nine per cent increase the previous year and a more than trebling of filings from 2019 to 2021.

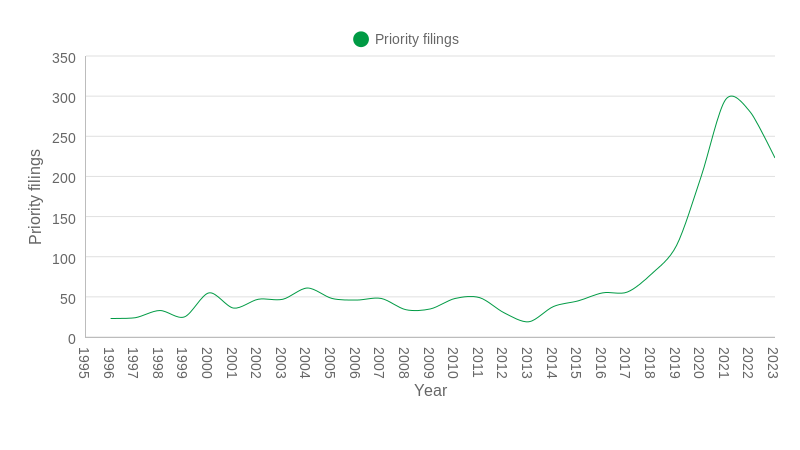

The annual drop in patent applications for plant-based meat has continued for a second year, falling 20% from 280 to 223. This followed the sector’s all-time peak innovation activity in 2021, reaching 296 patent filings.

Appleyard Lees’ Emily Bevan-Smith, patent attorney, said: “In the cultivated meat sector, funding, regulation and consumer uptake remain key challenges for innovators, alongside up-scaling and production efficiency.”

James Myatt, partner at Appleyard Lees, said: “In plant-based meats, sales fell by 12% and some manufacturers have either reduced operations or gone into administration.”

Increasing the appeal of meat alternatives – and cutting costs

Despite the relative drop in innovation activity, new patent filings for cultivated meat technologies include ways to reduce production costs and increase efficiency, add nutritional components and ingredients to culture media, improve texture, flavour and smell via improved fibre structures and use fats and genetically modified cells/cell lines.

In plant-based meat, companies are filing patents relating to advances in lentil flour, pea protein and corn protein alternatives, techniques to improve the texture and structure of plant-based meat alternatives, as well as novel soybean and soy protein-based meat compositions and plant-based fish meat alternatives.

Myatt added: “Global patent activity in the cultivated meat sector shows a strong push to appeal to consumers by creating products that closely resemble conventional meat in flavour, texture, nutritional value and cooking behaviour. For plant-based meats, innovations relating to plant-based fish appeared prevalent among many of the top filers.”

Countries

Lack of regulatory consensus for cultivated meat products in the US has likely contributed to the more than 40% fall in patent applications in the country (2022 to 2023) – now making it only the marginal leader in the sector ahead of Europe and the Republic of Korea.

Despite US federal agencies approving various cultivated meats for consumption, some state authorities have begun banning or enforcing strict product labelling – therefore affecting consumer perception and investor confidence. An anti-cultivated meat stance in Europe – such as moves in Italy and France to ban its production and sale – may have led to the almost 25% drop in the continent’s patent activity.

However, Japan’s published roadmap for the cultivated meats industry and Prime Minister’s endorsement has helped fuel a more than 100% increase in patent applications.

The US experience for plant-based meat-related innovation mirrors its cultivated meat counterpart, with a 37% drop in patent filings, while Europe has taken the lead with a total of 85 in 2023.

Companies

Among companies active in cultivated meat technology, Dutch company Meatable BV was the top filer, with applications focused on culturing and maturing cells while improving flavour with increased fat.

South Korean business, Hanwha Solutions Corporation, is investing in cell culture media and improving product texture and taste.

In the UK, Ivy Farm Technologies, a leader in cultivated meat manufacturing, has filed patent applications relating to genetically modified and manipulated cells, bioreactors for culturing the cells, cell culture methods, substrate assemblies for culturing cells and artificial meat products.

Cargill and Unilever dominate plant-based meat-related patent filings, with – for example –innovation in wheat gluten alternatives to minced meat.

*Inside Green Innovation: Progress Report – Fifth Edition, examines patent filing data through 31 Dec 2023, the latest date complete filing data is available from public sources.

**Appleyard Lees’ Inside Green Innovation: Progress Report – Fifth Edition is available to read here.